1.Introduction

The 1 billion USD China-Caribbean Infrastructure Loan was one of the six policy measures announced by Vice Premier Wang Qishan on behalf of the Chinese government at the Third China-Caribbean Economic and Trade Cooperation Forum in September 2011. In June 2013, during his visit to Trinidad and Tobago, President Xi Jinping announced to offer 1.5 billion USD to China-Caribbean Infrastructure Special Loan for the friendly countries of the Caribbean in order to further strengthen cooperation in finance and investment between China and the Caribbean countries, and improve infrastructure development in Caribbean countries. The loan will be undertaken by the China Development Bank.

2.Features

Taking the China-Caribbean Infrastructure Special Loan Business as an opportunity to stimulate Chinese enterprises to use EPC, BOT, BT, PPP and other cooperation models to carry out projects such as project contracting, equipment export and long-term investment, operation management, etc. in the region. The maximum use of“multiplier effect” of infrastructure projects will promote the sustainable economic and social development in the Caribbean and enhance the overall level of cooperation between China and the Caribbean.

3.For customers

Transportation infrastructure (roads, ports, airports, railways), electricity, energy, transportation, urban public facilities, communications, free trade parks, construction, agriculture, environmental protection, tourism, logistics, and other infrastructure projects in the Caribbean.

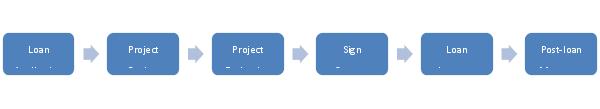

4.The Application Process

Project development can be completed by hand-in-hand the government or enterprises in the host country with Chinese-funded enterprises, and a formal loan application form to the China Development Bank should be submitted. The loan application form shall include project-related information, including but not limited to the borrower, total project investment, loan amount applied for, loanholder or project company’s financial status, project financing structure, loan term, loan usage, repayment method, and guarantee method, project schedule, contact information, etc. After receiving the project loan application form, CDB will conduct the preliminary review of the project first, and then directly contact the project party that has passed the preliminary review, carry out due diligence survey, project review and submit the assessment report to CDB’s loan committee. After approval by CDB’s Banking Committee, CDB will negotiate with the project party and sign a loan agreement.